F1: Hollywood stars Reynolds and McElhenney among new investors in Team Alpine

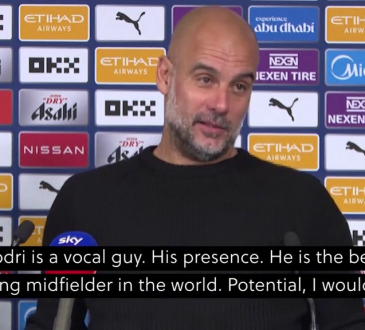

The Dynamic duo of Hollywood stars, Ryan Reynolds and Rob McElhenney, have shifted their sights to motor racing as part of a group of investors taking a 24% equity stake in Formula One team Alpine.

The deal, which is said to be worth about $218 million, values Alpine Racing, which is fifth in this year’s F1 constructor’s championship, at around $900 million.

The F1 team’s parent company, Renualt, announced the news of the deal on Monday, saying that the two actors, who own English football side Wrexham, are joined in the investment by Otro Capital and RedBird Capital Partners, with Michael B. Jordan also a part of the investors.

“The transaction values Alpine Racing Ltd. around $900 million following this investment and is an important step to enhance our performance at all levels,” the team said in a statement by chief executive Laurent Rossi. “It will accelerate Alpine’s growth plans and sporting ambitions in F1.”

Reynolds and McElhenney completed a $2.5 million takeover of Welsh football team Wrexham in November 2020. The takeover by the two movie stars propelled the club into the limelight as they secured promotion to the fourth tier of English football for the forthcoming season.

American investment company RedBird is an investor in Fenway Sports Group, the owner of Premier League side Liverpool and the Boston Red Sox baseball team. They also bought Italian Serie A club AC Milan in August 2022 in a deal worth 1.2 billion euros and have a controlling stake in French Ligue 1 side Toulouse.

Renault revealed that Alpine Racing SAS, the company manufacturing F1 engines in France, is not part of the transaction and will remain entirely owned by Renault Group.